Financing A Project Diagram

Let me preface this article by stating I am an architect and not an accountant or a finance professional, but without a proper financial foundation for a project, it cannot happen. For this reason, we have come to understand the many approaches that people use to finance their design and construction projects.

Fixing up your home can be emotionally and financially rewarding. For many people, their home is both the biggest and best investment of their lifetimes. Adding to that investment carefully and intelligently is like buying more of a great stock when it is still available at a low price. For this reason, the first prudent step to make is to determine which way is the real estate moving in your area. The second step is to confirm that you can build or renovate a new square foot of space for the same or less than that renovated area is worth in the market. If those two elements of the marketplace are generally positive, then a renovation or new construction may well be a smart investment for you.

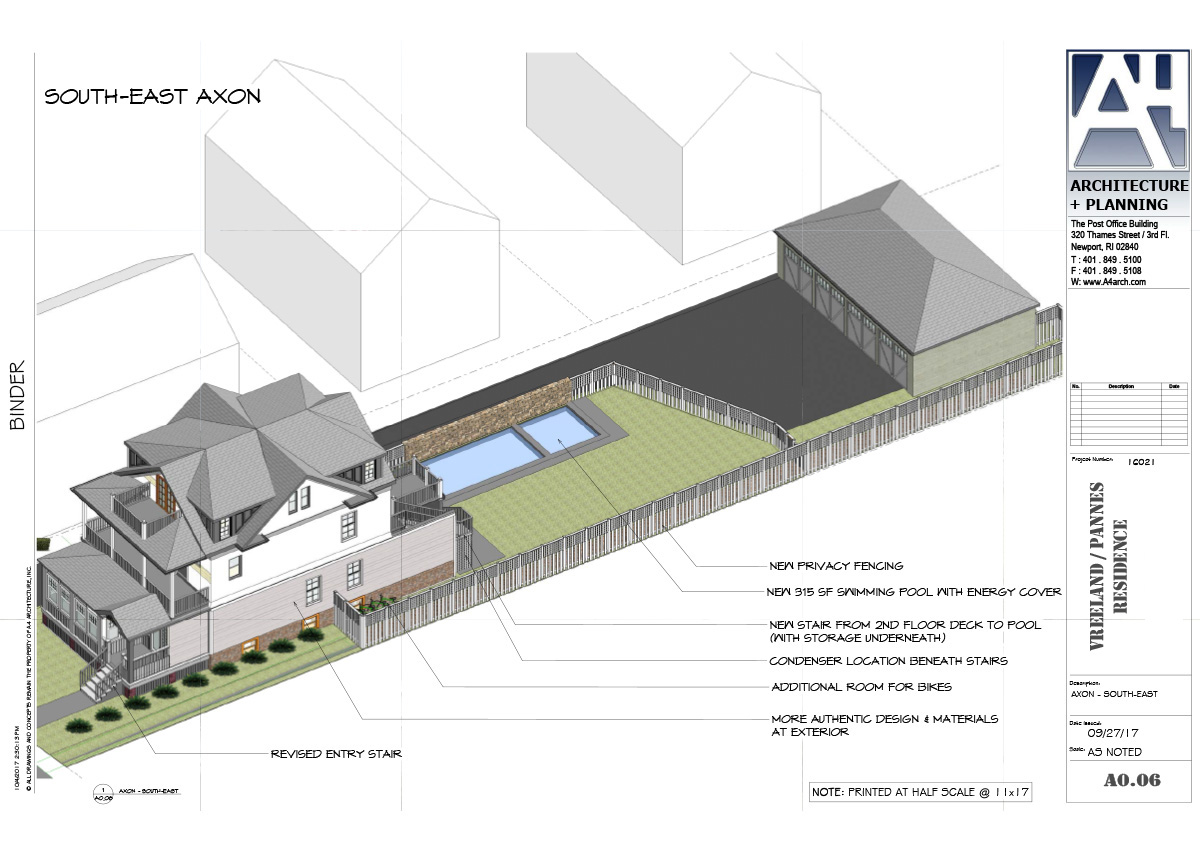

Previous Project Axon Design Iteration (Newport, Rhode Island)

The second caveat is to do careful planning. It may be tempting to try to “save” money by skipping the design and moving directly ahead with construction, but in the vast majority of instances, this will cost you both additional time and money as discoveries are made and changes to the design have to be undertaken in the field. One essential value of design is that it helps you anticipate and minimize the cost of construction through good planning and competitive bidding of the work. That being said here are some of the primary ways people undertake financing their design and construction projects:

Previous Project During Construction ( Newport, Rhode Island)

Cash: For those fortunate enough to have the full project cost available in liquid assets, paying in cash offers several advantages. You avoid accruing interest, simplify the process, and potentially negotiate better deals with contractors. However, depleting your savings for a renovation should be carefully considered, especially if it impacts emergency funds or future financial goals. With low-interest rates currently available on many cash accounts, this is a particularly attractive alternative since you won’t be giving up much interest income. However, if the money is in a high-flying stock that you would have to sell, the decision becomes somewhat harder.

Tapping into Equity: Homeowners with accumulated equity in their property have two attractive options:1) the Home Equity Loan (HELOC) and 2) the Cashout refinancing. Home Equity Loans act like a credit card secured by your home’s value. You’re approved for a maximum amount and can draw funds as needed, offering flexibility for phased projects. Interest rates are typically lower than personal loans, but remember, you’re using your home as collateral, so defaulting on the loan carries serious consequences. This allows you to keep your primary loan in place, which is desirable if you are fortunate to have a low-interest mortgage.

The Cash-Out Refinance option replaces your existing mortgage with a new, larger one, providing the difference in cash for your project. It can be advantageous if you secure a lower interest rate than your current mortgage, but closing costs can be significant, and extending your loan term increases the overall interest paid. This is a viable option when you hold a high-interest rate mortgage and rates have come down while the value of your property has gone up.

Previous Project After Construction (Newport, Rhode Island)

Personal Loans: These are unsecured loans that offer a lump sum of cash with fixed monthly payments and repayment terms. Approval depends on your creditworthiness, and interest rates can be higher than with equity-based options. However, personal loans offer flexibility, and quick funding, and don’t require putting your home at risk. They offer a wide range of options but you must plan on the additional payments required to cover the loan.

Government Loans: For specific renovation projects that improve energy efficiency or accessibility, government programs might offer loans with favorable terms and subsidies. The Federal Housing Administration (FHA) offers the 203(k) loan for renovations alongside home purchase, while the Department of Energy provides grants for weatherization improvements. Research available programs to see if they align with your project goals.

Credit Cards: While convenient for smaller purchases, credit cards are generally not recommended for major renovations due to their high interest rates, compounding debt quickly. However, some cards offer introductory 0% APR periods, which can be helpful for short-term financing of smaller projects if paid off diligently before the interest kicks in. Consider this option very carefully as it is far from ideal.

Do your research to choose the best option, which will depend on your unique personal and project circumstances. Consider these factors:

–Project cost and scope: Large-scale renovations might require equity-based options, while smaller projects offer more flexibility.

–Financial situation: Evaluate your savings, credit score, and risk tolerance before opting for debt-based financing.

–Interest rates and fees: Compare interest rates, closing costs, and other associated fees across different options.

–Repayment terms: Ensure the chosen option aligns with your comfortable monthly payment range.

Previous Project After Construction (Newport, Rhode Island)

Remember, careful planning and budgeting are crucial for a successful renovation journey. Consult financial advisors and compare offers from multiple lenders before making a decision. With the right approach and responsible financing, your dream home renovation can become a beautiful reality and a solid investment. Be sure to do your research, find the right architect and professionals to help you and keep track of all your expenses as the design adds to the cost basis of your property and can be deducted from the profit at the eventual sale of the property when that occurs. Good luck and we wish you a wonderful outcome in your endeavor!

Looking to remodel your home? Let’s connect.

Join the Architectural Forum to stay up-to-date with architectural news from Rhode Island and abroad.

Ross Cann, RA, AIA, LEED AP, is an author, historian, teacher and practicing architect living and working in Newport, RI. He holds degrees in Architecture and Architectural History from Yale, Cambridge, and Columbia Universities. He is a Leadership in Energy and Environmental Design Accredited Professional.

At A4 Architecture + Planning we are expert at integrating building codes into our designs to provide safer and more long-lasting building solutions for our clients. If you are interested in learning more about what can do for you reach out to us at any time!